san antonio local sales tax rate 2019

The County sales tax rate is. The portion of the sales tax rate collected by San Antonio is 125 percent.

Understanding California S Sales Tax

The Fiesta San Antonio.

. 1000 City of San Antonio. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. There is no applicable county tax.

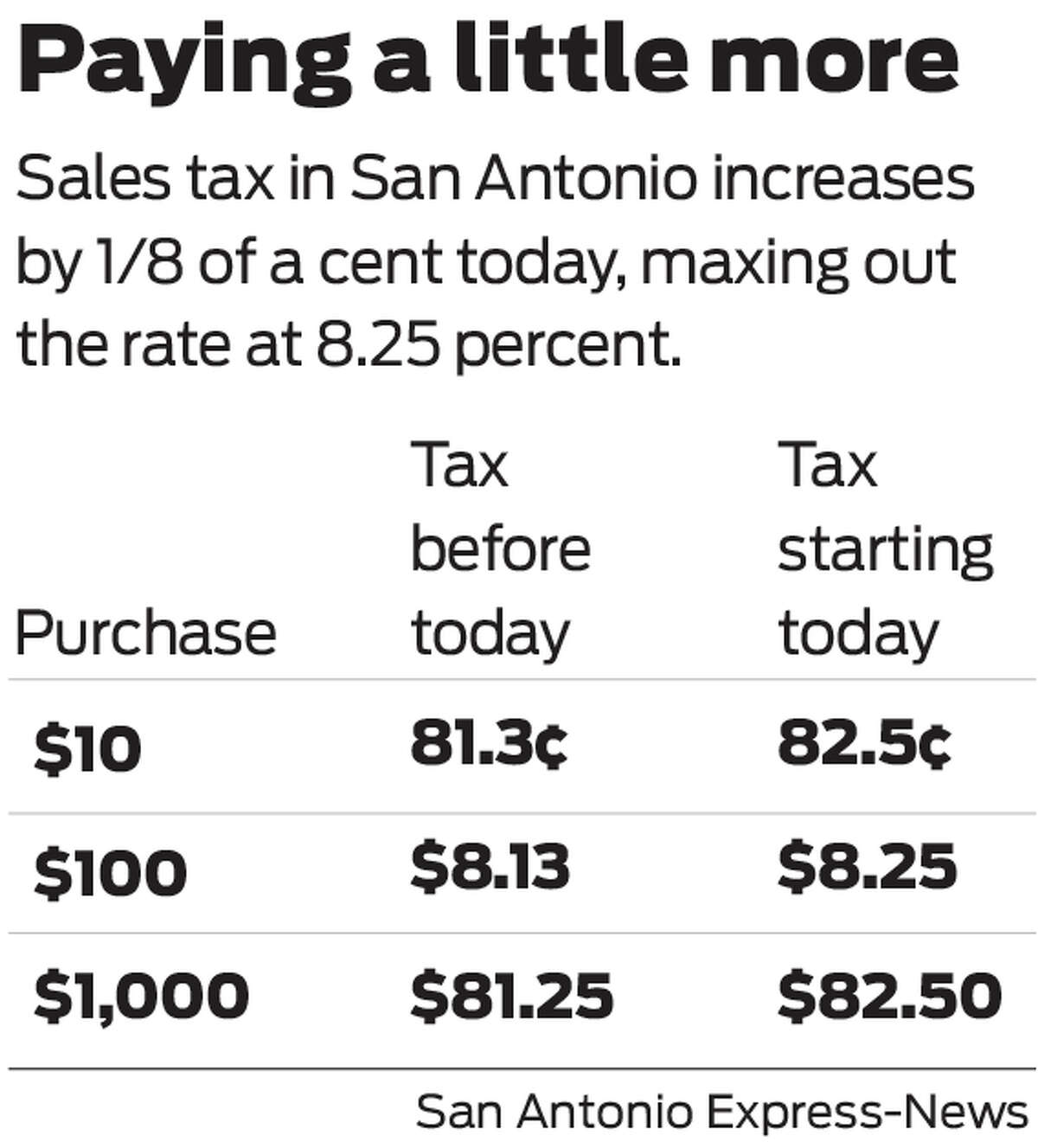

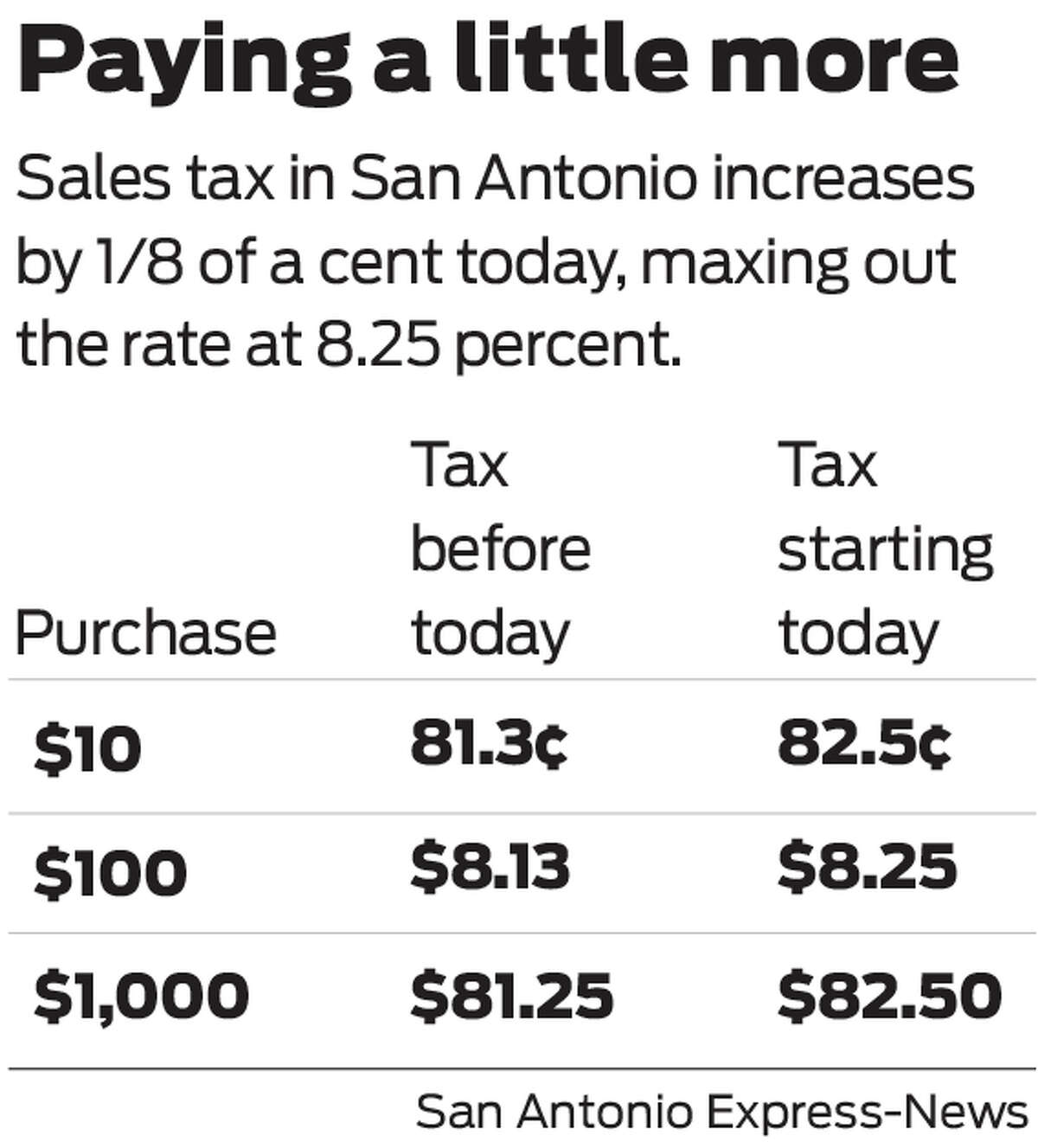

The San Antonio sales tax rate is. The current total local sales tax rate in San Antonio TX is 8250. The 825 sales tax rate in San Antonio consists of 625 Texas state sales tax 125 San Antonio tax and 075 Special tax.

The minimum combined 2022 sales tax rate for San Antonio Texas is. Homestead exemptions allow homeowners to decrease the. The Texas sales tax rate is currently.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. This is the total of state county and city sales tax rates. To offer college guidance to local students.

San Antonio collects a 2 local sales tax the maximum local sales tax allowed under Texas law. The City of San Antonios Hotel Occupancy Tax rate is 9 percent comprised of a 7 percent general occupancy tax and an additional 2 percent for the Convention. Did South Dakota v.

San Antonio TX Sales Tax Rate The current total local sales tax rate in San Antonio TX is 8250. The 7 sales tax rate in San Antonio consists of 6 Florida state sales tax and 1 Pasco County sales tax. Sales and Use Tax San Antonios current sales tax rate is 8250 and is distributed as follows.

San antonio property tax rate 2019. With local taxes the total sales tax rate is between 6250 and 8250. 0125 dedicated to the City of San Antonio Ready to Work Program.

San Antonio has a higher sales tax than 100 of Texas other cities and counties. The effective tax rate for the city of San Antonio this year is 54266 cents per 100 valuation. Texas has recent rate changes Thu Jul 01 2021.

You can print a 7 sales tax table here. 127 rows Nineteen major cities now have combined rates of 9 percent or higher. So with all of those ruled out who are the power brokers moving San Antonio forward.

San Antonio collects the maximum legal local sales tax. 0500 San Antonio MTA Metropolitan Transit Authority. Name Local Code Local Rate Total Rate.

Bexar County lowered its tax rate last year to. 0125 dedicated to the City of San Antonio Pre-K 4 SA initiative. 45 rows The five states with the highest average local sales tax rates are Alabama 514 percent.

Average of local sales taxes as of January 1 2019 to give a sense of the average local rate for each state. There is no applicable city tax or special tax. Wayfair Inc affect Texas.

The sales tax jurisdiction name is San Antonio Atd Transit which may refer to a local government division. San Antonio hasnt increased its property tax rate in years but rising appraised values have kept its average tax bill consistently on the rise. The December 2018 total local sales tax rate was also 8250.

0250 San Antonio ATD Advanced Transportation District. The current total local sales tax rate in san antonio tx is 8250. 05 lower than the maximum sales tax in FL.

Counties in texas collect an average of 181 of a propertys assesed fair market value as property tax per year. It spans 10 days. Select the Texas city from the list of cities starting with A below to see its current sales tax rate.

Sales Tax Rate Changes in Major Cities. It doesnt just do one fiesta. Up to 24 cash back San antonio texas sales tax rate 2019 San Antonio Texas knows how to party.

San Antonio has a higher sales tax than 100 of Texas other cities and counties. 4 rows San Antonio TX Sales Tax Rate. Table 1 provides a full state-by-state listing of state and local sales tax rates.

The San Antonio Texas general sales tax rate is 625. The December 2017 total local sales tax rate was also 8250. The current total local sales tax rate in San Antonio.

San Antonio has a higher sales tax than 100 of Texas other cities and counties. For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at. 0133674 is for debt payments and the remaining 0342927 is for operations and maintenance in the general fund.

California City and County Sales and Use Tax Rates Rates Effective 10012018 through 03312019 City Rate County Acampo 7750 San Joaquin Acton 9500 Los Angeles Adelaida 7250 San Luis Obispo Adelanto 7750 San Bernardino Adin 7250 Modoc Agoura 9500 Los Angeles Agoura Hills 9500 Los Angeles. In 2019 Fiesta Week will be held from Thursday April 18 through Sunday April 28. For tax rates in other cities see Florida sales taxes by city and county.

And that week isnt just one week long. Twenty-five major cities saw an increase of 025 percentage points or more in their combined state and local sales tax rates over the past two years including 10 with increases in the first half of 2019. It does a whole Fiesta Week.

Every 2019 combined rates mentioned above are the results of Texas state rate 625 the county rate 0 to 05 the San Antonio tax rate 0 to 1375 and in some case special rate 05 to 2. Arrowbear Lake 7750 San Bernardino Arrowhead Highlands 7750 San Bernardino Arroyo Grande 7750 San Luis Obispo Artesia 9500 Los Angeles Artois 7250 Glenn Arvin 8250 Kern Ashland 9250 Alameda Asti 8250 Sonoma Atascadero 7750 San Luis Obispo Athens 9500 Los Angeles Atherton 9250 San Mateo. The City of San Antonio has an interlocal agreement with the Bexar County Tax Assessor-Collectors Office to provide property tax billing and collection services for the City.

15 States With No Income Tax Or Very Low Which States Can Save You The Most Bhgre Homecity

Understanding California S Sales Tax

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Tax Information City Of Katy Tx

Understanding California S Sales Tax

Understanding California S Sales Tax

Want A Break On Property Taxes These San Antonio Communities May Keep More Money In Your Pocket

Sales Tax Rates In Major Cities Tax Data Tax Foundation

Sales Tax Increase To Fund Pre K 4 Sa Starts Today

Understanding California S Sales Tax

This Is My Home Zip Code So Just Holler If You D Like To Know What S Happening In Yours Marketreport Ph Phoenix Real Estate Lowest Mortgage Rates Marketing

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption

Texas Sales Tax Guide For Businesses

Texas Sales Tax Guide And Calculator 2022 Taxjar

Understanding California S Sales Tax

Taxes And Incentives Bulverde Spring Branch Texas Edf

Sa May Be Forced To Cut Property Tax Rate Council Also Considering Raising Homestead Exemption