stock option tax calculator canada

Stock option deduction ie 50 4000 Net Taxable Employment Income 4000 Where an employees stock options qualify for the 50 deduction the stock option benefit is effectively taxed as a. You can calculate your Annual take home pay based of.

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Management Rental Property Income Property

Under the current employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid.

. Option grants that qualify for stock option deduction. The Stock Calculator is very simple to use. Deduct CPP contributions and income tax.

However you also have a graphic design business. 2 deals with the CCPC at an arms length and 3 the employee stock option price including any amount. This entry is required.

Calculate the Annual tax due on your Capital Gains in 202223 for Federal Provincial Capital Gains tax. Important Note on Calculator. Fidelitys tax calculator estimates your year-end tax balance based on your total income and total deductions.

Stock Option Deduction Stock option benefit as previously calculated 8000 Less. Thus making a stock option very tax-efficient. Report a problem or mistake on this page.

Abbreviated Model_Option Exercise_v1 - Pagos. Select Province and enter your Capital Gains. This entry is required.

You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you. Enter an amount between 1 and 1000. For more information refer to Security options deduction for the disposition of shares of a Canadian-controlled private corporation Paragraph 110 1 d1.

Nil Note 1 C920000. Treatment under current law. Provided certain conditions are met the employee can claim an offsetting deduction equal to 50 of the taxable benefit.

The calculator will show your tax savings when you vary your RRSP contribution amount. The Stock Option Plan. For CCPC employers dealing at arms length benefit is only recognized when shares are disposed Tax costof the shares acquired on exercise Exercise price stock option benefit cost to acquire option if any generally tax cost will be the FMV of shares on exercise.

Employee Stock Option Calculator Estimate the after-tax value of non-qualified stock options before cashing them in. When determining the amount of the security option benefit subject to income tax withholding we will permit the employer to reduce the benefit by 50 using the Security options deduction under paragraph 110 1 d. The options were granted within.

This benefit should be reported on the T4 slip issued by your employer. Under paragraph 1101d of the Income Tax Act employees of a CCPC may deduct one half of the employee stock option benefit when computing their taxable income if the employee. 1 received common shares upon exercising the employee stock option.

You will face tax on the 10000 benefit this is where the idea of stock options should be of interest to you. Stock option tax calculator canada. Annual Stock Option Grants Inputs.

Option grants that do not qualify for stock option deduction. This calculator illustrates the tax benefits of exercising your stock options before IPO. The tax calculator is updated yearly once the federal government has released the years income tax rates.

Click to follow the link and save it to your Favorites so you can use it again in the future without having to input your information again. Prairies Tax Markets. Enter the commission fees for buying and selling stocks.

Please select all that apply. Subsection 110 1 of the Income Tax Act allows the employee to report only half of the benefit derived from exercising the employee stock option. Under the employee stock option rules in the Income Tax Act employees who exercise stock options must pay tax on the difference between the value of the stock and the exercise price paid.

The taxable benefit is the difference between the fair market value FMV of the shares or units when the employee acquired them and the amount paid or to be paid for them including. How much are your stock options worth. Please enter your option information below to see your potential savings.

So lets say you rack up 25000 in trading losses this tax year. Deducting Losses Unfortunately as a day trader you cannot utilise the 50 capital gains inclusion rate on your profits. Taxation at the employees marginal tax rate.

Total taxable income in year of exercise. For example the option price is 10 for 15 shares and the employee exercised the option when 15 shares were worth 20. Specify the Capital Gain Tax rate if applicable and select the currency from the drop-down list optional.

50 of the value of any capital gains are taxable. Just follow the 5 easy steps below. Enter an amount between 3 and 25.

However you can deduct 100 of your trading losses against other sources of income. This entry is required. This usually happens in late January.

Locate current stock prices by entering the ticker symbol. Option grants that qualify for stock option. The Canadian Annual Capital Gains Tax Calculator is updated for the 202223 tax year.

Abbreviated Model_Option Exercise_v1 -. Considering certain conditions are met you can claim a deduction equal to 50 of the stock benefit. Youll pay capital gains tax in Canada on the difference when you buy a share and then sell it for a higher price.

The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates. This Tax Insights discusses the new employee stock option rules and answers some common questions on the topic. This permalink creates a unique url for this online calculator with your saved information.

Enter an amount between 0 and 10000. By including this 10000 on your tax return you could deduct 5000. This entry is required.

Annual Capital Gains Tax Calculator 202223. The Stock Option Plan was approved by the stockholders of the grantor within 12 months before or after the date of adoption of the Plan. The stock option benefit is taxable in the year of exercise Exception.

Enter the purchase price per share the selling price per share. The Stock Option Plan specifies the employees or class of employees eligible to receive options. If you buy a share for 1000 and sell it for 2000 you.

The employees benefit inclusion is 20 10 10. This capital gains tax reduction doesnt apply for day traders who pay 100 tax on income from capital gains. Enter an amount between 0 and 20.

This calculator illustrates the tax benefits of exercising your stock options before IPO. The Stock Option Plan specifies the total number of shares in the option pool. Enter the number of shares purchased.

Capital Gains Tax Calculator For Relative Value Investing

The Free And Easy Way To Calculate Acb And And Track Capital Gains

Paying Tax On Stock Options A Guide For Canadians By Stern Cohen

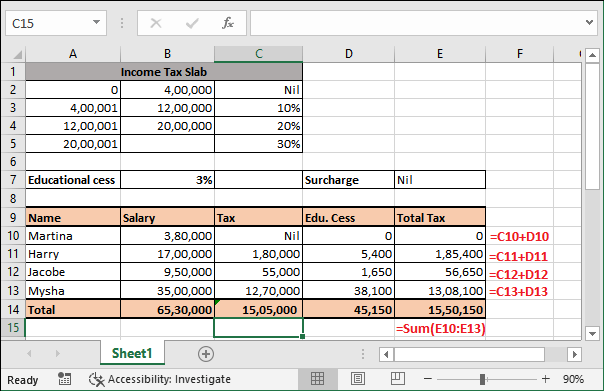

What Is The Formula To Calculate Income Tax

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

Canada Annual Capital Gains Tax Calculator 2022 23 Salary

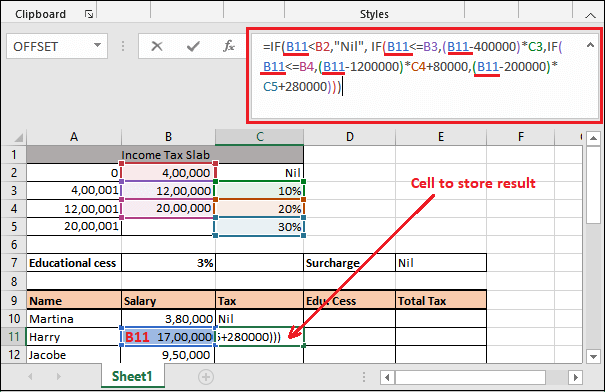

Income Tax Calculating Formula In Excel Javatpoint

How Is Taxable Income Calculated

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

Capital Gains Tax Calculator For Relative Value Investing

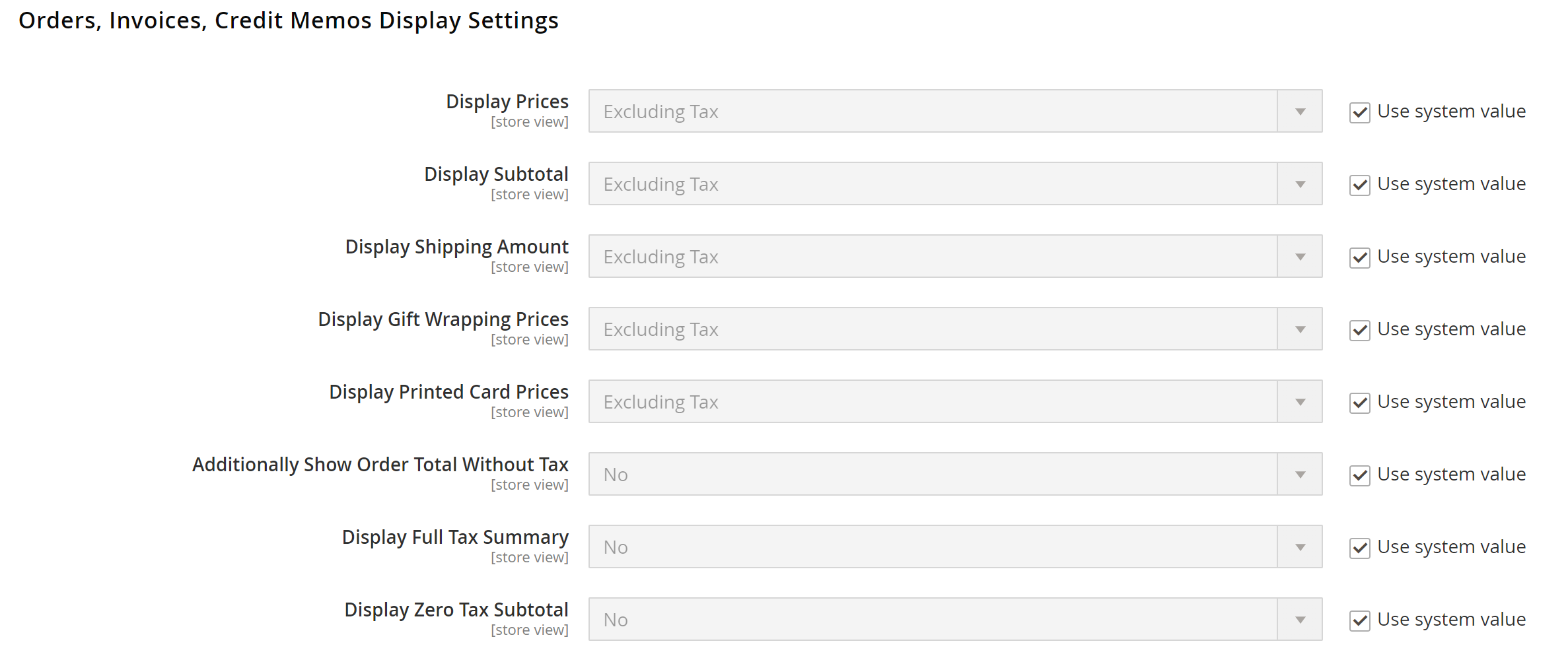

Tax Adobe Commerce 2 4 User Guide

Taxtips Ca Cpp Retirement Pension Calculator Information Page Retirement Pension Calculator Retirement

Income Tax Calculator Fy 2021 22 Calculate New And Old Regime Tax

Bc Income Tax Calculator Wowa Ca

Income Tax Calculating Formula In Excel Javatpoint

Income Tax Calculating Formula In Excel Javatpoint

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure

Corporate Tax Calculator Template Excel Templates Excel Templates Business Tax Business Structure